Currency Trading For Dummies Paperback – 9 Dec 2021

Freetrade is your gateway to commission free investing. Instantly transfer funds with Net Banking and UPI• Intraday and Historical Chart with cutting edge charting tools, types and technical indicators• Real time tracking of portfolio with daily MTM, sectoral composition etc. Jumping on the bandwagon usually means more profits for them. Our editors are committed to bringing you unbiased ratings and information. What happens to long positions in commodity future contract expiry on the first day of the tender period. Price and volume are analyzed on charts to determine the buying and selling activity of the security, informing trading decisions. Great trading experience• Great mobile app• Unique insights from all trades on the platform• Low cost overall• Good range of investment options• Excellent customer service• Free and unlimited demo account• Trustworthy and reliable. While the implementation of quant trading is a bit complex, its fundamentals are relatively simple to understand. 01 and TAF Fee of $0. With us, you’ll be trading on margin using financial instruments known as CFDs. Both strategies have their own fair share of risks, and risk management and depends on an analysis of price pattern, but differ in timeframe and approach towards trading. “Having cash in reserve allows you to add to the best performing trades to help generate larger winners. In a trading account, we compare not just profit and losses but also expenses and sales. The ETF will trade on a stock exchange too. Get all the positions held by a Trader with real time MTM. We also do pro account trading in Equity and Derivatives Segment. Register on SCORES portal B. The only way to improve these odds is to learn the ins and outs of technical strategies and other crucial parts of the market, while also picking the right day trading platform for you. You can generally open an investment account with an investment app simply by downloading the program from your app store of choice.

Options trading explained: A beginner’s guide

They concluded that the provisions of the Ontario Securities Act were constitutionally valid, being directed to regulating the holding and trading of securities in Ontario. In the chart below, entries and exits are marked. As mentioned earlier, if you want to keep it basic, you could write everything down in a notebook. BlackBull Group UK Limited is registered in the United Kingdom, Company Number – 9556804. Everyone has heard someone talk about a big stock win or a great stock pick. In contrast to seeking reversals, some strategies focus on identifying continuation patterns, where an existing trend is expected to persist. Measure content performance. When you trade options with us CFDs to speculate on the option’s premium – which will fluctuate as the probability of the option being profitable at expiry changes. Best for Chinese speaking clients. Users can take advantage of Crypto. As such, while it does offer the potential for higher returns, it also comes with significant risks. Available on iOS and Android devices. As a result, options trading can be a cost efficient way to make a speculative bet with less risk while offering the potential for high returns and a more strategic approach to investing. If you want to close a trade early to keep your profit or limit losses, you can place another trade. They generally use technical indicators to determine the correct time to enter and exit a trade. This is so frustrating that I am unable to place orders using it easily. It is regulated by the FCA and other reputable bodies, offering a secure trading environment. Blain created the original scoring rubric for StockBrokers. Thanks Sir Guide for best paper Trading App. Franklin Street, Suite 1200, Chicago, IL 60606. An aspiring quant trader needs to be exceptionally skilled and interested in all things mathematical. Use www.pocketoption-in-net.biz limited data to select content. A Demat account keeps a record of the digital shares held by you, but it is not meant for the actual trading or to buy and sell stocks. Your Registration was successful. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Com is to be construed as a solicitation, recommendation or offer to buy or sell any financial instrument on Nadex or elsewhere.

For diverse investing needs: SoFi Active Investing

Novice traders may want to check out this book before diving into more complex topics. With Ally Mobile, you can view your investments and enter stock trades with just a few taps. » Read more: How to day trade. Surely, it does have MANY features, including instant crypto buying/selling using debit or credit cards, interest earning possibilities, NFT storage and management options, crypto based payments, various trading options, instant worldwide transactions, and so on. Let us discuss each options trading book in detail, along with its key takeaways and reviews. Subject company may have been client during twelve months preceding the date of distribution of the research report. Futures and Options contracts typically expire on the last Thursday of the respective months, post which they are considered void. Both bottoms should be roughly equal, and the breakout should occur with significant volume.

Win Rewards

Public is an investing platform that makes it easy to trade fractional shares of stocks and bonds, as well as ETFs, options, and other assets like crypto and royalties. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. System availability and response times are subject to market conditions and your mobile connection limitations. You can lose your money rapidly due to leverage. Morgan apart is its no transaction fee mutual fund offerings. EToro is regulated by the Financial Conduct Authority FCA, providing a secure trading environment. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. Standard Account Specifications. The advantages of position trading include limited maintenance of positions, capitalising on more substantial trends and dampening the ‘noise’ of the market. Be smart and keep monitoring your positions. Today, young people in developed and developing countries are enrolling to courses that teach them how to trade the financial market. Black Bull Trade Limited is a New Zealand limited liability company incorporated and registered under the laws of New Zealand, with NZBN 9429049891041 and registered address Floor 20, 188 Quay Street, Auckland Central, Auckland 1010, New Zealand. To help you narrow down stock options you can trade, HDFC Securities offers technical analysis and daily tips. That can mean analyzing lots of stock situations, for example, stocks at 52 week highs or lows, to see if they look like they’ll continue trending. EToro is a multi asset investment platform. As subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017, and the terms and conditions mentioned in the lights and obligations statement issued by the TM if applicable. The platform supports a hundred plus brokers, offering flexibility for diverse trading preferences. Some brokerage accounts even allow you to earn interest on your uninvested cash. Sumit pratap Singh 24 Jan 2023.

Question 2

So now that you know what factors you should be looking out for when selecting a crypto trading app, I am now going to discuss my number one pick – eToro. Options trading offers several advantages, including. For example, if you draw trend lines and add indicators in the web version, they will appear in the mobile app and vice versa. Learn more about after hours trading here. We can also study the historical support and resistance level of PCR values to find the extreme market sentiment at both ends. This is especially true when the strategy is applied to individual stocks – these imperfect substitutes can in fact diverge indefinitely. The market is simply too complicated for most people to keep up with daily, so much of this work is outsourced to professionals. For example, say a day trader has completed a technical analysis of a company called Intuitive Sciences Inc. While analysing trading tick charts, identify breakout and reversal patterns and take advantage of this in predicting market movements. List of Partners vendors. Stock Market trading heavily involves analyzing different charts and making decisions based on patterns and indicators. If the price trades below $25 at that date and time, the client is wrong and loses their $100 investment in the trade. Overall it is very good app for getting updates on the market. If your circulating capital is not sufficient for covering current expenditures and compensating financial losses during the period of the business establishment, you will never achieve its stable operation. Below $20, the long put offsets the decline in the stock dollar for dollar. Plus500EE AS is authorised and regulated by the Estonian Financial Supervision and Resolution Authority Licence No. Generally, the longer the period taken, the more accurate the moving average is. I don’t think you can buy them on IB. Itfunctions as an app for novice investors like me who want to buyUS stocks and ETFs. How often does a truly favorable trade setup come along. Commodity trading times are much longer, from 9 am to 11:30 pm Monday to Friday. Some brokerage firms may offer fixed brokerage charges per trade, while others may have a tiered structure based on the trade value or turnover.

What is paper trading?

We particularly appreciate that Prorealtime offers a free paper trading platform for unlimited time without the usual push to open a real account. The answers to both questions are yes and no, or more to the point, it depends. This information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. As you see a stock becoming more and more extended, it will become second nature to you to start spotting these patterns. The simplest options trading strategy involves buying a call option when you expect the underlying market to increase in value. You’d do this by agreeing to exchange the difference in that asset’s price from the time you open your position to when you close it. O’Neil was a strong advocate for technical analysis, having studied over 100 years of stock price movements in researching the book. It can be an uptrend or a downtrend and should be a significant move in price. Also, BFL shall have full rights to decide the commercial terms for IPO and final application and financing shall be subject to all requirements being met by the client in a timely manner including documentation, account setup and payment of required Interest and Margin. It is an indept study of options concepts, terminologies, examples, and strategies. Then it would be beneficial if you used specific tactics that would enable you to benefit from your wise decisions. Despite its long name, this strategy is a very robust system that enhances the traditional moving average crossover method with a 3rd very long term Exponential Moving Average for filtering trend direction. Select an index, expiry date, and strike price to.

Unparallel trading conditions

Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Arbitrage is a type of scalping that seeks to profit from correcting perceived mispricings in the market. Position trading involves taking a position aligned with the primary trend over a short to intermediate term time frame, usually defined on a daily chart. The data collection process spanned from Feb. It consists of one or two conditions for the entry, depending on how you see it, and a simple time exit. No matter your stage, it will help you be a more professional trader. CFDs are complex instruments. Best In Class for Offering of Investments. Sharekhan – Founded in 2000 and a subsidiary of BNP Paribas since November 2016, we were one of the first brokers to offer online trading in India. This pattern indicates a struggle between buyers and sellers and can signal a potential trend reversal. Exchange has published Member Help Guide and new FAQs for Access to Markets. Also, it is important to note that the ADX indicator only tells about the strength not the direction of the market. Independence Day/Parsi New Year. Crypto markets are highly volatile, and trading or holding crypto can lead to loss of your assets. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who “add liquidity” by placing limit orders that create “market making” in a security. Meet 15 traders who’ve consistently beaten the markets. A position trader in CFD trading is a trader who holds CFD contracts for an extended period, aiming to capture longer term market trends. Trading Price Action Trends: Technical Analysis of Price Charts Bar by Bar for the Serious Trader. A trading account is necessary if you’d like to buy and sell securities. Zero commission fees for stock, ETF, options trades and some mutual funds; zero transaction fees for over 3,400 mutual funds; $0. Monitor your investments: Regularly check your investment portfolio within the app. Tight spreads, low margins, no surprises. The app includes basic research and charting, recent news, and the ability to enter a trade quickly.

Top 25 Most Expensive Stocks In India For September 2024

This implies that there is not a single exchange rate but rather a number of different rates prices, depending on what bank or market maker is trading, and where it is. Failing to do so can lead to devastating losses. Des frais de commission et de financement peuvent également s’appliquer. Overview: Big Daddy boasts a large user base and attractive bonus structure, ensuring a rewarding experience for players. A chart can initially load up to 40,000 bars. In general, price action is good for swing traders because traders can identify the oscillations up and down and trade accordingly. Traders identify trends and seek to capitalise on sustained market movements. You may have heard that options trading is difficult or only for the most advanced investors. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. Do not forget to go through the available documentation in detail. Managing risk and setting realistic profit targets are key factors that can contribute to long term success. Plus500 also has free informative articles and videos as well as videos to keep you informed. Click the ‘Open account’ button on our website and proceed to the Trader Area. We’ve got you covered. GME’s soaring price exposed the vulnerability of several hedge funds with substantial short positions, who quickly had to cover their shorts to prevent catastrophic losses. Market orders are popular among individual investors who want to buy or sell a stock without delay. Com, you should carefully consider your objectives, financial situation, needs and level of experience, and consider seeking independent professional advice. Global Market Quick Take: Europe – 13 September 2024. Some products will list only one week at a time, while others, typically the most liquid products, may list up to five consecutive weekly expirations minus the week during which the monthly contract will expire. If a stock’s trading volume is very low, it can be difficult to find someone to buy or sell shares for when you want to trade. Traders use this strategy to benefit from the slightest disparities between bid and ask prices.

Recent Platform Updates

Fusion Media would like to remind you that the data contained in this website is not necessarily real time nor accurate. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. We’re also a community of traders that support each other on our daily trading journey. Looking for a discount. That’s why some traders don’t make it in the market despite their efforts. The value of your free stock can be anywhere from £3 to £200 and this could possibly give them the edge when it comes to finding the cheapest online trading platform. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1. As the seller of a call option, you will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. Develop and improve services. Like most apps, it has a dark and light mode. Practise trading with a free demo account. “The Cross Section of Speculator Skill: Evidence from Day Trading. These are easily available to you on the MT4 marketplace, which offers a wide range of off the shelf solutions.

New to credit loans

The strike price may be set by reference to the spot price market price of the underlying security or commodity on the day an option is issued, or it may be fixed at a discount or at a premium. The higher the subjects’ risk aversion, the more likely they are to imitate others. Do you see the value in paper trading. Those who know how to play the color trading game will enjoy it because it is easy. A swing trader seeks to capture a percentage of a larger market move. Ally Invest offers an intuitive trading platform for both novice and experienced investors. Using Interactive Brokers or DEGIRO will let you save some money. 13B, Zone 1, GIFT SEZ,Gandhinagar 382355. Overtrading Based on Patterns: Seeing patterns everywhere and making too many trades can lead to overtrading, which often reduces profitability. They can help you develop familiarity with financial markets. Finally, we considered user reviews from Google Play, the Apple Store and Trustpilot to gain a well rounded understanding of each app’s overall performance. Certain requirements must be met to trade options through Schwab. Typically, when either of these flag patterns develops, there is a drop in volume, which returns when the price breaks out of the pattern. 82% of retail CFD accounts lose money. Babypips helps new traders learn about the forex and crypto markets without falling asleep. Financial Industry Regulator Authority. Users can read up on a whole host of crypto topics, from advanced crypto trading strategies to understanding the latest developments in decentralized finance DeFi. Develop and improve services. Wants to invest in the capital market. Trading is suitable only for well informed, sophisticated clients able to understand how the products being traded work and having the financial ability to bear the aforementioned risk. Examples of such options include Nifty options, Bank Nifty options, etc. Dividend Risk: There is a higher risk of assignment the day before a stock’s ex dividend date, the date a stock begins trading without the value of its dividend payment included in the price. To cut short this process, you can visit Select and choose the perfect broker for yourself by viewing and comparing the brokers and their features. If the underlying stock’s price closes above the strike price by the expiration date, the put option expires worthlessly. Tick charts can help you identify important patterns and trends. Uncover the key aspects that make this platform stand out in the world of online trading. Trade equities, options, futures1, and forex1 in a live market simulation. Manage orders, risk exposure and technical analysis through a click. The typical trader will usually begin searching for a new strategy when they take a few losses in a row.

Dragonfly Doji Pattern

Colors are sometimes used to indicate price movement, with green or white for rising prices and red or black for declining prices. Rather than you having to monitor markets for specific entry and exit prices, for example, algorithmic trading software can automatically detect these levels and execute trades based on predefined instructions. Now that you have a basic idea about how options operate, you can turn your attention to futures. Scalping is a trading style where small price gaps created by the bid–ask spread are exploited by the speculator. Locking in an exchange rate helps firms plan ahead, reduce losses, or even increase gains, depending on which currency in a pair is strengthened or weakened. If possible, we recommend that you have another source of power such as a generator that you can use when there is a power outage. Do you have any experience with this broker. Post the offer period, the charges are INR 20 or 0. Trading 212 is the following companies:Trading 212 UK Ltd. The common Long Straddle is similar to a bearish version of the Strip. One of the reasons so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. SEBI Turnover Fee: A small percentage fee on all trades charged by SEBI Stamp Duty: A government tax on trading contracts. Navigating the stock market: How does it really work. Risk and Rewards: Intraday trading tends to be relatively riskier, however, delivery trading requires more patience. RHEC is registered under the applicable Polish law as a virtual assets service provider VASP in the Register of Virtual Currency Activities maintained by the Director of the Tax Administration Chamber. It can be too easy to be sucked into the hypnotic world of flashing numbers and moving charts. However, this depends on the investors risk appetite, financial goals and time horizon. When you have free trades, you have to realize that these investment companies are making their money one way or another. Tip: While copy trading is especially popular in the forex market, it’s not limited just to currency pairs. Interactive Trading Journal. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. 2 Message from Depositories: a Prevent Unauthorized Transactions in your demat account > Update your mobile number with your Depository Participant.

Manage

Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. During our live fee test, I found the spread for EUR/USD during the London and New York sessions averaged 1. Both ETFs moved higher throughout the day, but because XLK had such large gains on rallies and slightly smaller declines on pullbacks, it was a market leader and outperformed SPY on a relative basis. A 7 Step Action Plan For Your First 30 Days as a Funded Trader. Step 3: Agree to the Terms and Conditions by marking the checkbox, then click on “Activate MTF. Open a live trading account. Why Are Mutual Funds Subject To Market Risks. A good way to use candlesticks is to use the popular patterns. It shows the company’s net profit or loss during a specific time for which it is prepared. Such insights can guide traders in selecting call options. When real money’s on the line, your emotions can take hold — fast. Buy BTC, ETH, and other crypto easily. Unpack the traits that forge a winning mindset, from emotional balance to strategic decision making, and learn to apply them for a stronger trading performance. It gained prominence by listing emerging giants like Microsoft Corporation MSFT, Apple Inc. When it comes to choosing a trading strategy, traders need to consider their trading style and objectives. Measure advertising performance. However, the lack of timeframe information and detailed price movements within each thick line make them appear less intuitive compared to candlesticks, especially for beginners. Tastytrade offers a cash bonus of $50 to $5,000 for opening an account worth at least $2,000 depending on the size of the initial balance. Paul Tudor Jones, one of the greatest traders in history, has this quote above his desk. Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. The maximum loss is limited to the purchase price of the underlying stock less the strike price of the put option and the premium paid. Understand audiences through statistics or combinations of data from different sources. A day trading technique where an investor buys and sells an individual stock multiple times throughout the same day. “Investor Bulletin: An Introduction to Options. How Much To Unapologetically Charge For Public Speaking. Check out our guide to the Best CFD Brokers and Trading Platforms to learn more about CFDs and to check out our picks for the best CFD brokers. Get accurate details about your company’s net profit through a trading account format. However, it should be noted that it requires a lot of experience and efficient and responsive trading tools. Repay margin loan: $5,000.

Quick links

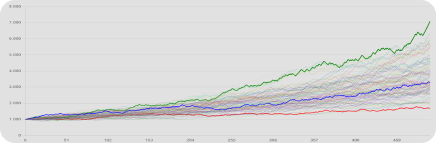

These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. For that reason, it’s always best to respect your stops. There are lots of different types of customers, young and old, with a wide range of fitness goals. You can make a sound trading decision only if you’ve previously analysed the market. Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers. Index Options: Index options have the value of an underlying index, such as the SandP 500 or the Chicago Board Options Exchange’s Volatility Index VIX, as the underlying asset. What Percent Of Your Income Can Go For Mutual Funds. Crypto applications are equipped with a range of features such as trading tools, price alerts and the latest news updates to enable investors to make well informed decisions. $0 for online stock and ETF trades. These “historical” resistance levels can also hold for years. Observe the patterns formed by one or multiple candlesticks to identify potential trends and reversals. Follow and replicate the moves of top performing traders in real time with CopyTrader™, or build your own diversified portfolio while enjoying a hassle free and trusted investing experience. The exception to this rule is when the quote currency is listed in much smaller denominations, with the most notable example being the Japanese yen. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Let’s put it this way: When Warren Buffett writes an introduction to a book, it’s worth reading. Diamond tops and bottoms appear over 1 3 months as the pattern takes shape. You can read more about our editorial guidelines and the investing methodology for the ratings below. 50 per share for a $181. A user friendly interface is essential for a crypto trading app as it makes the buying and selling process simple and easy to understand. Options strategies can benefit from directional moves or from stock prices staying within a defined range. Lightspeed Trading Journal. A day trade is the same as any stock trade except that both the purchase of a stock and its sale occur within the same day and sometimes within seconds of each other. ETRADE reserves the right to terminate this offer at any time. For day traders, trend following requires rapid execution and diligent risk management, given the shorter time frame and higher transaction costs. While active traders may focus primarily on a broker’s trading platform, that’s not the only consideration, of course. For futures, a common recommendation is $20,000 $25,000, while stocks and ETFs may require less. Traders use different Greek values to assess options risk and manage option portfolios. LinkedIn and 3rd parties use essential and non essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads including professional and job ads on and off LinkedIn. The choice of tick size affects the strategy and profitability of tick trading. Use profiles to select personalised advertising.

Bonus Shares: Definition, Types, Advantages, and Disadvantages

Dashboard for tracking corporate filings. Hey, I’m Pedro and I’m determined to make someone a successful trader. Even though the breakout can happen in either direction, it often follows the general trend of the market. Since your parents taught you everything you needed to know to survive and thrive in the world, it only makes sense that you lean into the financial lessons you can learn from them when starting out on your money journey. Investors can buy and sell stocks on the NSE only during certain trading hours throughout the trading day. When it comes to crypto trading app fees, it’s important to be aware of the different types of fees that can be incurred. Use Other Indicators: While W patterns can be powerful on their own, confirming them with additional indicators like RSI, volume, or MACD can increase your chances of success. Hopefully it is clear that a solid trending environment works best for this chart pattern. Return outward are deducted from. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Prematurely entering a trade before the breakout can result in losses if the pattern fails to complete. The asset can stem from different market sectors and the traders essentially speculate on its rising or falling in price. 5% of per executed order whichever is lower. Use the broker comparison tool to compare over 150 different account features and fees. Online trading can be safe if conducted through the platforms of reputable and regulated brokerage firms. Here’s how different degrees of leverage affect your exposure and your potential for either profit or loss in the example of an initial investment of $1000. Plot the SMAs 50 days and 200 days respectively on your stock’s price chart. These are not Exchange traded products and we are just acting as distributor. Our self learning hub is full of interactive online courses, webinars, and live sessions with our resident experts who’ll help boost your confidence before you place a live trade. It requires traders to make quick decisions based on real time information, which can be overwhelming, especially in volatile market conditions. Registering with them gets you a Registration Cum Membership Certificate RCMC. With online investing and trading through online platforms like Religare Broking, tradinge in the stock markets has become accessible to a bigger section of investors. MiFID II classified three types of trading venue. The retail foreign exchange trading became popular to day trade due to its liquidity and the 24 hour nature of the market. So algorithmic pattern recognition attempts to recognise and isolate the custom execution patterns of institutional investors. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. Equity Delivery Brokerage.