How Does a Wraparound Mortgage Work?

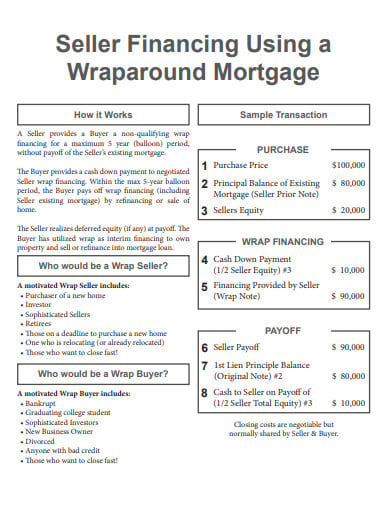

A wraparound mortgage allows a property seller to keep their original mortgage loan in place while they agree to finance the bulk of the purchase for a new buyer. The seller is effectively financing a subordinate mortgage for their buyer while keeping the original mortgage in place. It works much like a “subject to” purchase with a few key differences.

What Is A Wraparound Mortgage? Definition & FAQs

What Is a Wraparound Mortgage and How Does It Work?

Mary Walker Miller on LinkedIn: How Does a Wraparound Mortgage Work?

10+ Wraparound mortgage Templates in DOC

A Guide to Wraparound Mortgages and Risks Associated With The Due-on-Sale Clause?

Definition of Wraparound Mortgage, Clear Capital

What Is A Wraparound Mortgage?

Understanding Real Estate Wraps Wrap Around Mortgages Explained

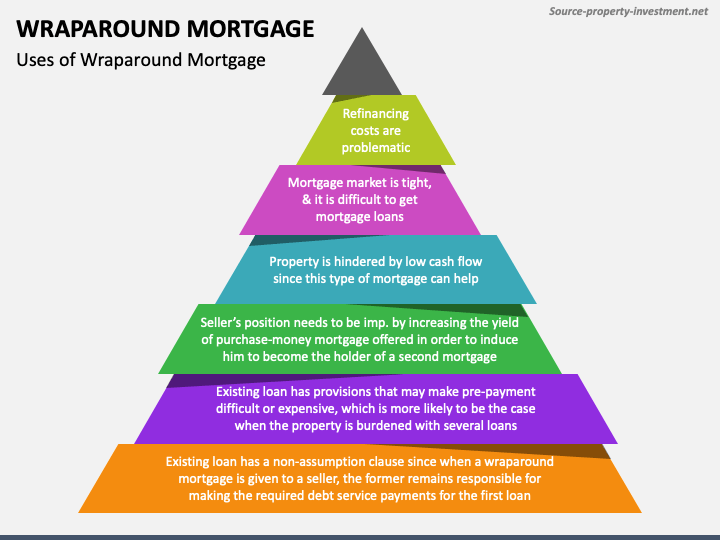

Wraparound Mortgage PowerPoint Template and Google Slides Theme