Section 44B: Income From Shipping Business For Non-Residents

Section 44B lays down rules for non-residents in shipping. Here’s all you need to know about presumptive income, tax rate and calculation.

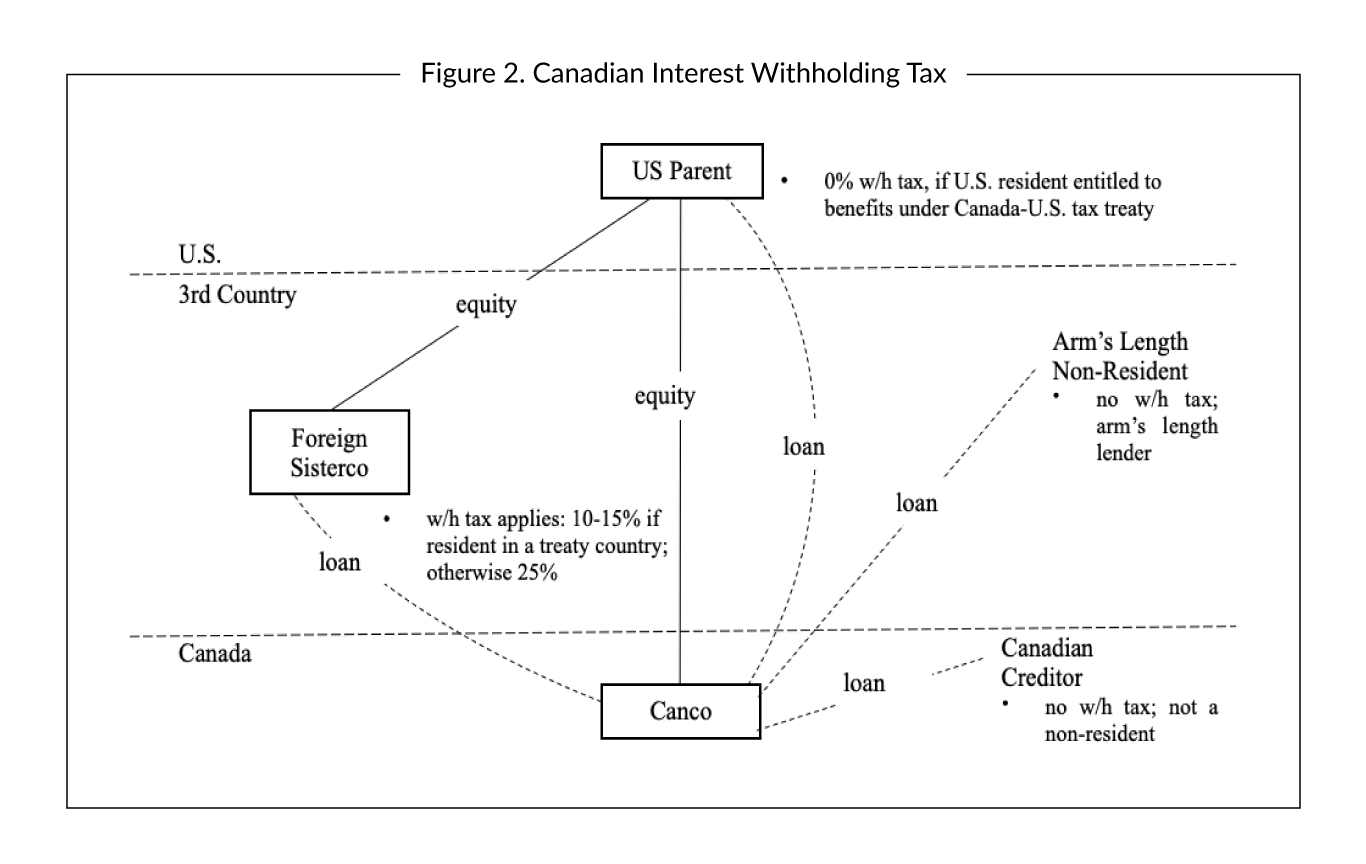

Payments From Canada

Taxability of non residents engaged in shipping business

Sea and Beyond - Freight Tax

Baltimore bridge collapse and port closure send companies scrambling to reroute cargo

Canada doubles international student income requirement

How To Start Dropshipping: A 9 Step Guide (2024) - Shopify Nigeria

Monthly Review The Fishing Revolution and the Origins of Capitalism

Know all about the applicability of Minimum Alternate Tax (MAT)

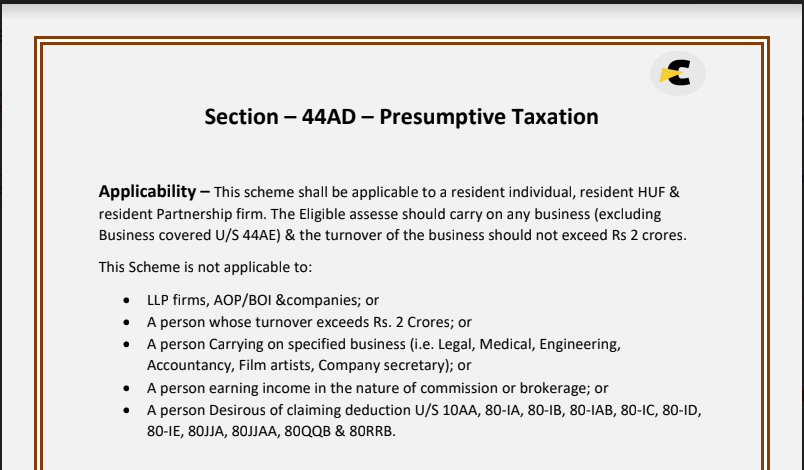

Presumptive taxation

What is Section 115BAA of IT Act - Features & Conditions

International Taxation: Taxation of Non-residents' Shipping Business-Section 44B of the Act – MTLiveCA

Section 44AD – Presumptive Taxation for small businesses

Connecting the GGH: A Transportation Plan for the Greater Golden Horseshoe

Inside Air's Quest to Seize the Skies

section 44b income from shipping business of a non resident, corporate tax, income tax act 1961